The easiest way to do this is to either pull up your banks statement or print it them off.

#BALANCING A CHECKBOOK UPDATE#

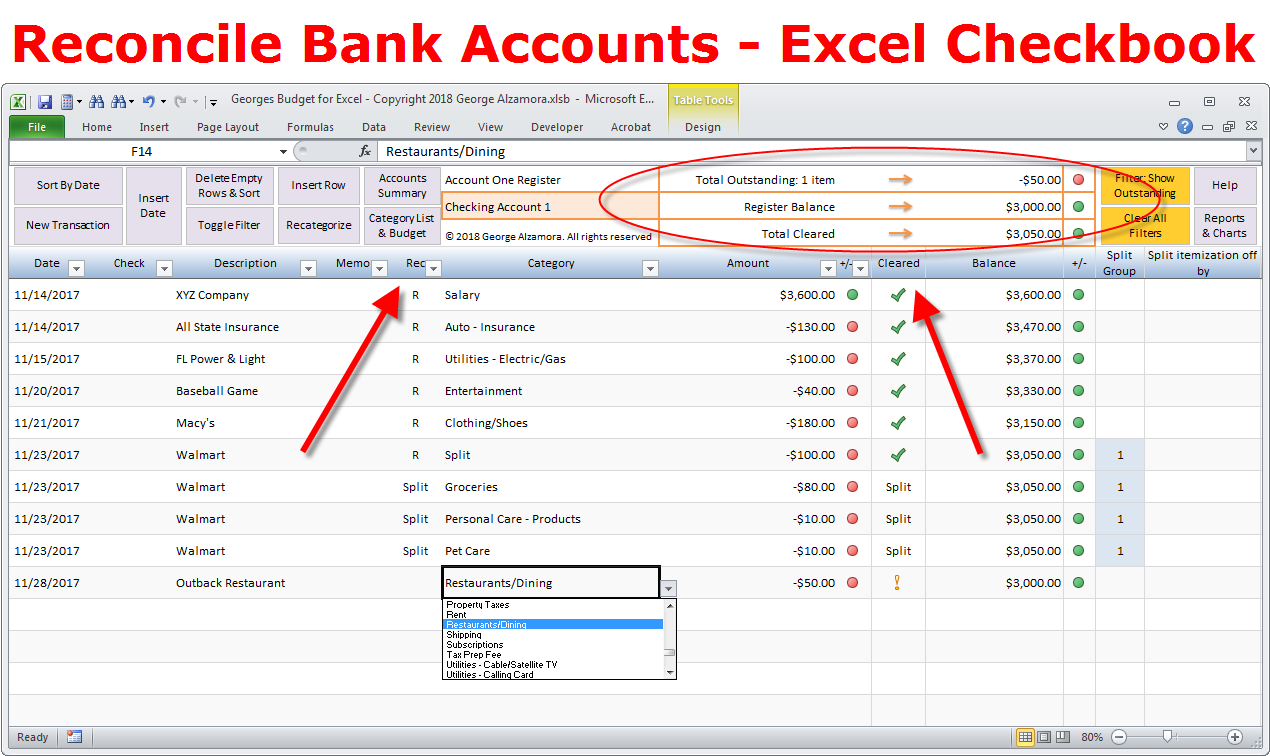

The more frequently you update your register and clear (check off) transactions as they are reflected in your checking account, the more accurate your register will be and subsequently, the more accurate picture you’ll have for exactly how much money you have at any point in time. So when you reconcile your checkbook, you are making sure what’s happened in your register (the list of transactions) matches what’s happening with the money in your bank account. The word reconcile simple means to make one account consistent (match) the other. Utilize Bank Statements to Reconcile Transactions and Balance Your Checkbook

It’s also especially helpful for families with more than one person drawing on a single account. This is an ideal tool for those who are working with a weekly or biweekly budget and you are trying to manage payments for your monthly bills and want to ensure that you have sufficient funds to cover your expenses at any point doing the month. You can see on any given day exactly what shape your bank account is in. The purpose of a checkbook transaction register is to stay on top of the money you have coming in and going out of your bank account every day.Īlso, you have the added benefit of tracking your balance on a daily basis.

What is the Purpose of a Checkbook Register? That money will be withdrawn at some point in the future when your check is presented for payment to the bank.

The money you’ve promised by issuing the check as a form of payment, doesn’t come out of your account the moment you present the check. A simple checkbook register is a tool where you can track your income and expenses: either as they happen or future payment occurrences.Īn example of a future payment would be if you write a check.

0 kommentar(er)

0 kommentar(er)